Unlocking the Secret to Long-Term Financial Bliss

Budgeting is a crucial aspect of managing your finances and achieving long-term financial success. It is a way to keep track of your income and expenses, ensuring that you are living within your means and saving for the future. However, many people struggle with budgeting and find it challenging to stick to a budget consistently. In this article, we will explore the secret to long-term financial bliss and how you can master budgeting for a secure financial future.

The secret to long-term financial bliss lies in creating a budget that is realistic, flexible, and tailored to your individual needs and goals. It is essential to take into account your income, expenses, debts, and financial goals when creating a budget. By doing so, you can ensure that you are not overspending, saving enough for the future, and working towards achieving your financial goals.

One of the keys to mastering budgeting is to track your expenses diligently. This includes keeping track of all your spending, whether it is on groceries, entertainment, or bills. By tracking your expenses, you can identify areas where you may be overspending and make adjustments to stay within your budget. This will help you to develop better spending habits and ensure that you are not living beyond your means.

Another important aspect of budgeting is setting financial goals. Whether you are saving for a new car, a down payment on a house, or retirement, having specific financial goals can help you stay motivated and focused on your budget. By setting achievable goals and tracking your progress, you can see the impact of your budgeting efforts and stay on track towards achieving financial bliss.

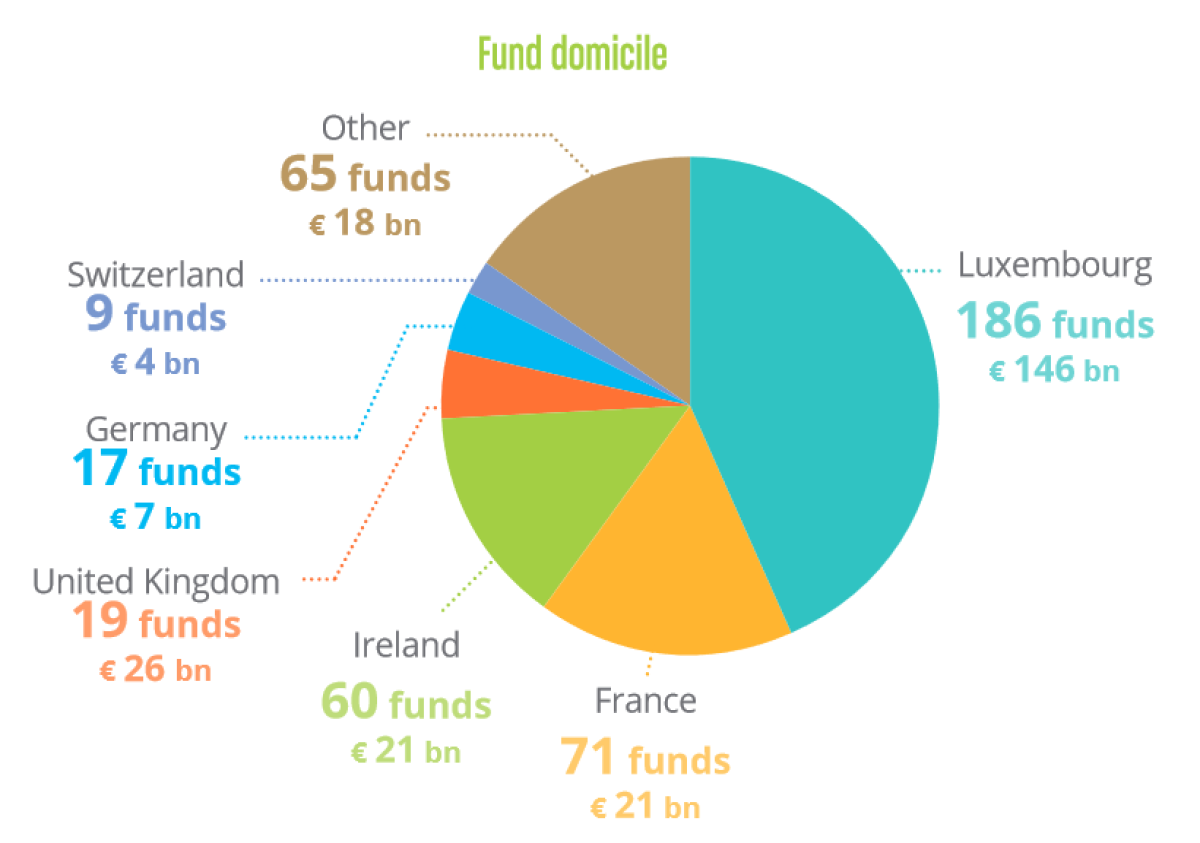

Image Source: cleanenergywire.org

In addition to tracking expenses and setting financial goals, it is crucial to review your budget regularly. Life circumstances change, and so should your budget. By reviewing your budget regularly, you can make adjustments as needed to account for changes in income, expenses, or financial goals. This will help you stay on top of your finances and ensure that you are always working towards achieving long-term financial success.

One of the most significant benefits of mastering budgeting is the peace of mind that comes with knowing you are in control of your finances. By creating a budget and sticking to it, you can avoid financial stress, debt, and uncertainty about your financial future. You can set yourself up for long-term financial bliss by taking charge of your finances and making informed decisions about your money.

In conclusion, mastering budgeting is essential for achieving long-term financial success and unlocking the secret to financial bliss. By creating a realistic budget, tracking your expenses, setting financial goals, and reviewing your budget regularly, you can take control of your finances and work towards a secure financial future. So, start today by creating a budget that works for you and watch as you move closer to financial bliss and long-term financial success.

Charting Your Course to Budgeting Mastery

Budgeting is a key component of achieving long-term financial success. It involves making a plan for your money, tracking your income and expenses, and making adjustments as needed. By mastering the art of budgeting, you can take control of your finances, reduce stress, and work towards your financial goals.

The first step in charting your course to budgeting mastery is to set clear financial goals. Whether you want to save for a new car, buy a home, or retire comfortably, having specific goals in mind will help you stay motivated and focused. Take some time to think about what you want to achieve financially and write down your goals.

Once you have your goals in place, the next step is to create a budget that aligns with them. Start by tracking your income and expenses for a month to get a clear picture of where your money is going. This will help you identify areas where you can cut back and save more. Be sure to include all sources of income and expenses, no matter how small.

After you have a clear understanding of your financial situation, it’s time to create a budget. Allocate a portion of your income to your various expenses, such as housing, transportation, groceries, and entertainment. Make sure to also include savings and investments in your budget. Remember, the key to successful budgeting is to spend less than you earn.

As you start following your budget, it’s important to track your progress regularly. Keep a close eye on your spending and make adjustments as needed. If you find yourself overspending in certain areas, look for ways to cut back. Consider using cash envelopes or budgeting apps to help you stay on track.

Another important aspect of budgeting mastery is planning for unexpected expenses. Life is full of surprises, and having an emergency fund can help you weather financial storms without derailing your long-term goals. Aim to save at least three to six months’ worth of living expenses in an easily accessible account.

In addition to saving for emergencies, it’s also crucial to save for the future. Whether you’re saving for retirement, a child’s education, or a dream vacation, setting aside money regularly can help you reach your goals faster. Consider automating your savings by setting up automatic transfers from your checking account to your savings or investment accounts.

As you continue on your journey to budgeting mastery, don’t forget to celebrate your successes along the way. Achieving financial goals takes time and dedication, so be sure to acknowledge your progress and reward yourself for reaching milestones. Whether it’s treating yourself to a nice dinner or splurging on a small luxury, recognizing your hard work can help keep you motivated.

In conclusion, mastering budgeting is essential for long-term financial success. By setting clear goals, creating a budget that aligns with those goals, tracking your progress, and planning for the unexpected, you can take control of your finances and work towards a brighter financial future. Remember, budgeting is a skill that takes time to develop, so be patient with yourself and keep pushing forward. With determination and discipline, you can chart your course to budgeting mastery and achieve your financial dreams.

Financial Acumen: Managing Budgets for Sustainable Growth